3-ish years with the AI Investor

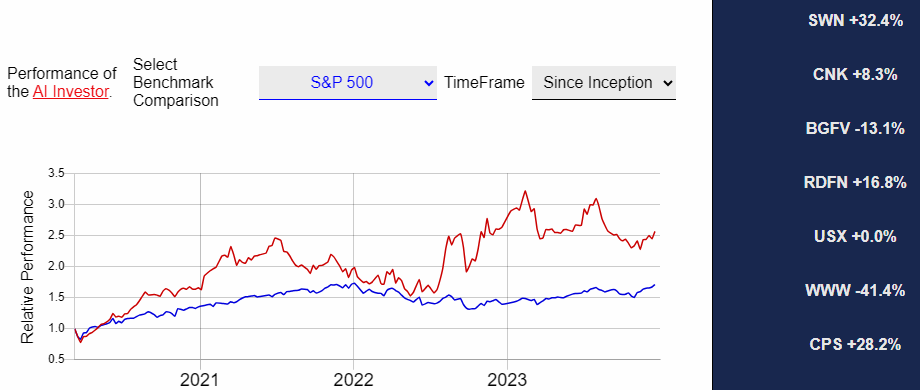

It's been roughly 3 years now since the AI Investor started (March 2020). Since then it has been quite volatile, though overall it's gone up about 2.5x, whilst the S&P500 has done 1.7x. ???

Does this mean it's proven itself? in my opinion not yet: bear in mind there were some pretty terrible investments around the latter half of 2021, and given the volatility I'd say it needs a few more swings to be sure that the overall performance compensates for the bad times.

It's a bit of a strange strategy I think. I work in finance as a quant, when I tell people in this industry about it I am often met with expressions of incredulity, though some think I should just start a fund already. It's very different from most "quant" stuff because I'm buying stocks and doing nothing the rest of the time. In the quant world there needs to be some special (and frequency > once/day) edge, either you are selling some derivative or option that needs very clever maths to value, or you are a market maker making doing of transactions a day, or you are a fund that uses stats to do dozens of transactions a day.

I find this funny, because Ben Graham was the first quant, and what I'm doing with the AI Investor is closer to what he was doing then than what quants do now. Just look at the simple price/earning ratio filters he (and possibly Mr. Buffett) came up with.

The AI Investor is a modern concentrated version of Ben Grahams methods, Ben Graham traded hundreds of stocks to spread his risk and make the statistics work out for sure. Here I'm holding ~7 stocks. The closest that I've seen is Joel Greenblatt. We know from his books that he uses statistical techniques to screen for stocks, and then he inspects individual stocks afterward. We know his fund did ~50%/year on average 1985-1994 however, we're definitely not making those kinds of returns.

So far, with 7 stocks per year, starting March 2020, the AI Investor has selected 28 stocks. There have been a fair share of misses, take a look at shoe maker WWW, it's lost 50% ?.

Going forward I'll be a bit more discerning after all the AI Investor filtering has been done. Old-fashioned research still carries the day because these are living, breathing businesses and there are a lot more features about a business that one can analyse than just the financial statement numbers.